Hybrid #7

他不沉默的样子、装、品味、俗气、兴趣养成理论,以及几串对投资的思考

© 林肇圀

摘录

我想象,他不沉默的时候是什么样子?

他一定也坐过绿皮火车。那时从湖北出发,只能坐火车,睡一晚,第二天一大早到北京。他会不会也有过买不到座位的经历?他也许是那种为了省钱一路站着的人,不会像我,明明买了卧铺票,还要点一碗50元却半生不熟的黄焖鸡米饭。

他是一个节俭的人,但对我很大方。小学时,我中午到爷爷奶奶家吃午饭,一般只有爷爷在家,奶奶在外摆摊卖布。我找他要零花钱买零食,他便从自己抽屉里拿出钢镚来。他的木质抽屉十分整洁,钱币整齐摆放在盒子里,旁边摞起几个记事本,角落还有一些姑姑的首饰。我总是贪心,觉得爷爷是温和内敛之人,如果找他多要点钱,他不会拒绝。我总是成功了,从他那里,我经常能拿一元甚至两元,而从其他人那儿,我只能拿五角。

张叔说以前的火车票3块钱一张,在爷爷的年代,也许更便宜吧?如果和他一起坐火车,他可能会给我点一餐,让我坐在沙发上。

不过其实,我并不确定他对我的情感是什么模样,也不确定自己对他是何种感情。

又到了下午四点,火车已经开了24小时。车厢里很安静,一些人在睡觉,隔壁卧铺的三个阿姨在聊年轻人不会讲云南话。我坐在走廊旁的椅子上,贴着车窗写日记:

“没有见到他最后一面,我没有掉眼泪。我是何时对他的感情开始淡漠的?又或许,我是否一直没有对他有过亲密的情感?… 毕竟我们从未有过深入的交流,毕竟他从未袒露过他的内心。”

他沉默地活,沉默地死。没有过情感表达的人,是否意味留不下情感的痕迹?但是,在这个问题之前,他是自愿沉默的吗?

我小时候,爷爷知道我喜欢吃糖醋排骨,也喜欢吃奶奶自制的热干面,照顾完我的午饭,他便回房,坐在窗边抽烟。有时我坐不住,说想出去玩,爷爷会牵着我的手出门走路。我向他展示地上捡到的树叶,他会尴尬地微笑回应:“好”,然后扭过头去,一言不发。

我想他也是想出门的。有一次,他独自出门散步了,几个小时没有回来,全家人很着急。不记得最后他们在哪里找到了爷爷,只记得将他接回家后,所有人教训了他一顿,指责他出门“非常危险”,下次再也不要出去了。他们就像对待一个不听话,需要管教的小孩。而爷爷极少回击,回到房内,仿佛无事发生,置身事外,旁观他人对自己的评判。

自此之后,他应该再也没有离开过家,或许他也渐渐放弃了出门。家庭聚会时,他是躲在房间或客厅角落里坐着抽烟的那位,眼神并非空洞,而是一副事不关己,无所谓的态度。毕竟我们在一旁所有的讨论,他都能听懂。

⤷ Wanqing Chen:二十八小时绿皮火车记

It’s never been so easy to pretend to know so much without actually knowing anything. We pick topical, relevant bits from Facebook, Twitter or emailed news alerts, and then regurgitate them. Instead of watching “Mad Men” or the Super Bowl or the Oscars or a presidential debate, you can simply scroll through someone else’s live-tweeting of it, or read the recaps the next day. Our cultural canon is becoming determined by whatever gets the most clicks.

[…]

What we all feel now is the constant pressure to know enough, at all times, lest we be revealed as culturally illiterate. So that we can survive an elevator pitch, a business meeting, a visit to the office kitchenette, a cocktail party, so that we can post, tweet, chat, comment, text as if we have seen, read, watched, listened. What matters to us, awash in petabytes of data, is not necessarily having actually consumed this content firsthand but simply knowing that it exists — and having a position on it, being able to engage in the chatter about it. We come perilously close to performing a pastiche of knowledgeability that is really a new model of know-nothingness.

[…]

The information is everywhere, a constant feed in our hands, in our pockets, on our desktops, our cars, even in the cloud. The data stream can’t be shut off. It pours into our lives a rising tide of words, facts, jokes, GIFs, gossip and commentary that threatens to drown us. Perhaps it is this fear of submersion that is behind this insistence that we’ve seen, we’ve read, we know. It’s a none-too-convincing assertion that we are still afloat. So here we are, desperately paddling, making observations about pop culture memes, because to admit that we’ve fallen behind, that we don’t know what anyone is talking about, that we have nothing to say about each passing blip on the screen, is to be dead.

⤷ Faking Cultural Literacy, Karl Taro Greenfeld, NYT

品味在創造屬於自己的東西時特別重要,不論是做研究、拍影片、寫程式都是一樣,即使有了主題,還是需要創作者做「選擇」,判斷需要添加什麼素材,亦或是更重要的,不要增加什麼與何時該停下來,透過一連串的判斷,仔細組織成自己的作品。品味是每個人都如此特別的原因,人們在這世界上各種有形和無形的資源中採集,動態形成屬於自己的組合。

⤷ Ya-Xuan:品味

這形形色色的事物間有一個公共的成分——量的過度:鉆戒戴在手上是極悅目的,但是十指尖尖都拶著鉆戒,太多了,就俗了!胭脂擦在臉上是極助嬌艷的,但是涂得仿佛火燒一樣,太濃了,就俗了!肚子對于人體曲線美是大有貢獻的,但是假使凸得像掛了布袋,太高了,就俗了!以此類推。同時我們胸中還潛伏一個道德觀念:我們不贊成一切夸張和賣弄,一方面因為一切夸張和賣弄總是過量的,上自媒人的花言巧語,下至戲里的丑表功,都是言過其實、表過其里的。另一方面也因為人家的夸大反襯出我們的渺小來,所以我們看見我們認為過當的事物,我們不知不覺地聯想到賣弄,不管那樁事物確是在賣弄(像戴滿鉆戒的手)或是出于不得已(像大肚子)。因此,我們暫時的結論是:當一個人認為一樁東西為俗的時候,這一個東西里一定有這個人認為太過火的成分,不論在形式上或內容上。這個成分的本身也許是好的,不過假使這個人認為過多了(too much of a good thing),包含這個成分的整個東西就要被認為俗氣。所以,俗氣不是負面的缺陷(default),是正面的過失(fault)。

……

俗的意思是“通俗”,大凡通俗的東西都是數量多的,價錢賤的;照經濟常識,東西的價值降賤,因為供過于求,所以,在一個人認為俗的事物中,一定有供過于求的成分——超過那個人所希望或愿意有的數量的成分。從“通俗”兩個字,我們悟到俗氣的第二個特點:俗的東西就是可以感動“大多數人”的東西–此地所謂“大多數人”帶著一種譴責的意味,不僅指數量說,并且指品質說,是卡萊爾(Carlyle)所謂“不要崇拜大多數”(don’t worship the majority)的“大多數”,是易卜生(Ibsen)所謂“大多數永遠是錯誤的”(a majority is always wrong)的“大多數”。

綜括以上來說,假使一個人批評一樁東西為“俗”,這個批評包含兩個意義:(一)他認為這樁東西組織中某成分的量超過他心目中以為適當的量。(二)他認為這樁東西能感動的人數超過他自以為隸屬著的階級的人數。

⤷ 錢鐘書:論俗氣

I think I do think sometimes we spend too much time on nostalgia. I think people always ask what was that based on or what was your inspiration? And sure, people have inspirations and they have unconscious thoughts in their heads, but true creative design, I’m talking about the fashion world, true creative designers, and I’m sure it’s the same with with your world, it’s original. It comes from their mind, not from somebody else’s mind. Maybe they had some influences, but the idea is theirs.

⤷ Anna Wintour Embraces a New Era at Vogue | The New Yorker Interview

“What are the consequences of that?” asked Paul O’Keefe, an assistant professor of psychology at Yale—NUS College. “That means that if you do something that feels like work, it means you don’t love it.” He gave me the example of a student who jumps from lab to lab, trying to find one whose research topic feels like her passion. “It’s this idea that if I’m not completely overwhelmed by emotion when I walk into a lab, then it won’t be my passion or my interest.”

That’s why he and two co-authors—Dweck and Greg Walton of Stanford—recently performed a study that suggests it might be time to change the way we think about our interests. Passions aren’t “found,” they argue. They’re developed.

In a paper that is forthcoming in Psychological Science, the authors delineate the difference between the two mind-sets. One is a “fixed theory of interests”—the idea that core interests are there from birth, just waiting to be discovered—and the other is a “growth theory,” the idea that interests are something anyone can cultivate over time.

[…]

Dweck told me that “find your passion” has a laudable history. “Before that, people were saying, ‘Find your genius,’ and that was so intimidating. It implied that only people who were really brilliant at something could succeed,” she said. “‘Find your passion’ felt more democratic. Everybody can have an interest.” But this study suggests that even the idea of finding your “true” interest can intimidate people and keep them from digging further into a field.

[…]

K. Ann Renninger, a professor at Swarthmore College who was not involved with the study, has researched the development of interests and said that “neuroscience has confirmed that interests can be supported to develop.” In other words, with the right help, most people can get interested in almost anything. Before the age of 8, she said, kids will try anything. Between the ages of 8 and 12, they start to compare themselves with others and become insecure if they’re not as good as their peers at something. That’s when educators have to start to find new ways to keep them interested in certain subjects.

⤷ ‘Find Your Passion’ Is Awful Advice, Olga Khazan

…from The Local News Business Model:

This last point is at the crux of why many ad-based newspapers will find it all but impossible to switch to a real subscription business model. When asking people to pay, quality matters far more than quantity, and the ratio matters: a publication with 1 valuable article a day about a well-defined topic will more easily earn subscriptions than one with 3 valuable articles and 20 worthless ones covering a variety of subjects. Yet all too many local newspapers, built for an ad-based business model that calls for daily content to wrap around ads, spend their limited resources churning out daily filler even though those ads no longer exist.

[…]

In short, every leg of the stool that supported the open web is at best wobbly: users are less likely to go to ad-supported content-based websites, even as the long tail of advertisers might soon lose their conduit to place ads on those websites, leaving said websites even less viable than they are today — and they’re barely hanging on as it is!

[…]

No, the real neglect and missed opportunity in terms of payments is happening right now: Microsoft is on to the right idea with its adoption of MCP and introduction of NLWeb, but its proposal, by virtue of not including native payments, isn’t nearly as compelling as it should be. The key difference from the 1990s is that on the agentic web native digital payments are both viable and the best possible way to not only keep the web alive, but also in the process create better and more useful AI.

⤷ The Agentic Web and Original Sin, Stratechery by Ben Thompson

- Spend time efficiently

- Choose good problems

- Have a bunch of them

- Make a list

- Integrate the list with your life

- Make your time higher quality

- Ease physical constraints

- Carry pen and paper

- Avoid being interrupted

- Ease mental constraints

- Eat, sleep, exercise

- Talk to cheerful people

- Share the load

- Procrastination and the mental force field

- Hard problems: break it down, simplify it, think about it

- Assigned problems: create a false assignment, don’t assign problems to yourself, make things fun

⤷ HOWTO: Be more productive, Aaron Swartz

- Selecting a Goal: main mission/quest, level up along the way, and side quests

- Getting Triggered: try again, be in a state where you can be consistently triggered

- Escape the Noise: have some time to reflect

- Shifting Your Perspective: a learning mindset

- Measure Your Progress: give yourself feedback

⤷ How I Study Consistently With A Full-Time Job, Jordan Brown

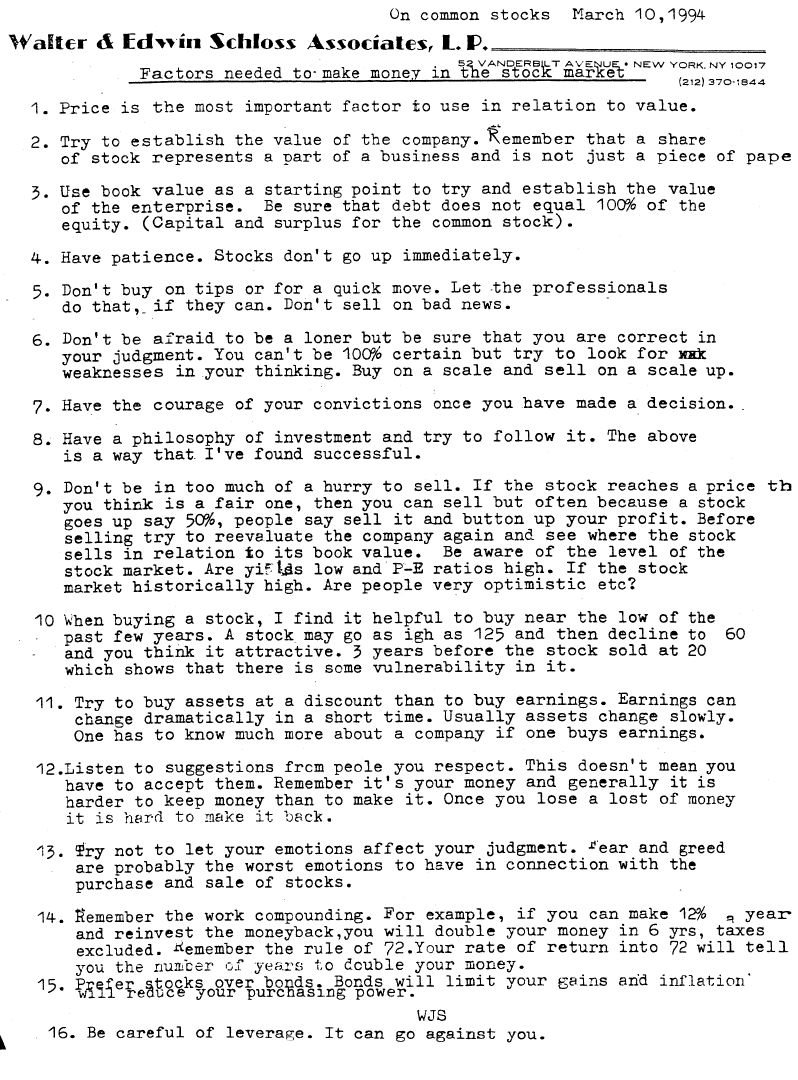

- Price is the most important factor to use in relation to value.

- Try to establish the value of the company. Remember that a share of stock represents a part of a business and is not just a piece of paper.

- Use book value as a starting point to try and establish the value of the enterprise. Be sure that debt does not equal 100% of the equity. (Capital and surplus for the common stock).

- Have patience. Stocks don’t go up immediately.

- Don’t buy on tips or for a quick move. Let the professionals do that, if they can. Don’t sell on bad news.

- Don’t be afraid to be a loner but be sure that you are correct in your judgment. You can’t be 100% certain but try to look for weaknesses in your thinking. Buy on a scale and sell on a scale up.

- Have the courage of your convictions once you have made a decision.

- Have a philosophy of investment and try to follow it. The above is a way that I’ve found successful.

- Don’t be in too much of a hurry to sell. If the stock reaches a price that you think is a fair one, then you can sell but often because a stock goes up say 50%, people say sell it and button up your profit. Before selling try to re-evaluate the company again and see where the stock sells in relation to its book value. Be aware of the level of the market historically high. Are people very optimistic etc?

- When buying a stock, I find it helpful to buy near the low of the past few years. A stock may go as high as 124 and then decline to 60 and you think it attractive. 3 years before the stock sold at 20 which shows that there is some vulnerability in it.

- Try to buy assets at a discount than to buy earnings. Earnings can change dramatically in a short time. Usually assets change slowly. One has to know much more about a company if one buys earnings.

- Listen to suggestions from people you respect. This doesn’t mean you have to accept them. Remember it’s your money and generally it is harder to keep money than to make it. Once you lose a lost of money it is hard to make it back.

- Try not to let your emotions affect your judgment. Fear and greed are probably the worst emotions to have in connection with the purchase and sale of stocks.

- Remember the work compounding. For example, if you can make 12% a year and reinvest the money back, you will double your money in 6 years, taxes excluded. Remember the rule of 72. Your rate of return into 72 will tell you the number of years to double your money.

- Prefer stocks over bonds. Bonds will limit your gains and inflation will reduce your purchasing power.

- Be careful of leverage. It can go against you.

⤷ On common stocks, March 10, 1994, Walter & Edwin Schloss Associates, L.P.

回看当时的很多判断,只是典型的外部正反馈:有人投关注、有人抛出估值、市场制造幻觉,整套节奏都是外部环境给出的。那段时间离所谓"成功"最近,也离实质积累最远。

……

这些工具表面上解决不同问题,但底层逻辑是一样的:把凭感觉的决策变成可回放、可复盘的流程。

⤷ 马大伟:三十五

不過最近我們有另一個心得:大家拼命學 prompt 的這件事,可能兩三年後就沒那麼重要了。因為 AI model 會越來越聰明,越來越會「通靈」,你根本不需要講得那麼仔細。到那個時候,身為一個操作者,真正需要的能力是什麼?

我們覺得是「辨別」。辨別 AI 講的到底是不是真的、是不是在騙你,或是它的邏輯是不是走歪了。這東西需要的不只是知識,更需要「常識」。

但回頭看我們自己這一代三四十歲的人受的教育,學校通常教了知識、教了技能,給了特定學科當作未來專業的基礎,但從來沒有一堂課是教怎麼擁有常識。

這真的很可怕。當有 AI 這麼 powerful 的工具,想藉助它跨到別的領域時,才赫然發現自己根本沒有一個常識的基底去判斷,AI 給的結果到底是不是對的。

尤其現在,我們每天在社群或任何地方,看到的內容越來越多是 AI 生成的,裡面可能充滿假新聞或各種被渲染的消息,該怎麼判斷?

這就是為什麼我們覺得《真確》這本 2018 年的老書在這個時代特別重要。它不是直接教你如何「邁向真實」,而是反過來告訴你,在這條路上,有十種會阻撓你的直覺偏誤。

這些偏誤其實都是你大腦為了節省耗能而發展出來的「偷懶機制」,它幫你快速篩選資訊,但也常常讓你遠離真相。如果我們要跳脫被這些謬誤支配的困境,就必須先了解它們是什麼。

書裡提到的十種謬誤,分別是:

- 二分化直覺偏誤:習慣把世界分成黑與白。

- 負面型直覺偏誤:總是把事情想得很糟。

- 直線型直覺偏誤:認為趨勢會像一條直線一樣無限延伸。

- 恐懼型直覺偏誤:因為恐懼而誇大危險。

- 失真型直覺偏誤:對事物的比例、大小有錯誤的概念。

- 概括型直覺偏誤:把不同的東西歸為同一類。

- 宿命型直覺偏誤:認為某些事是注定且無法改變。

- 單一觀點直覺偏誤:只相信某個權威或單一的解釋。

- 怪罪型直覺偏誤:出事了就一定要找個戰犯。

- 急迫型直覺偏誤:覺得每件事都很緊急,必須馬上行動。

首先,企業主的決策不一定都有策略脈絡可循,尤其當特定行動是「首次出現」的時候,最好不要過度解讀。

例如,市場(或媒體)通常會在一間公司成長的時候,將其所有行為解讀成策略的一環,因為替成長中的公司寫什麼故事都有機會是對的。

但,我個人幾次比較深刻的經驗是:通常都是老闆的一時興起。

然而,真正應該注意的,是這些企業在「繳完學費」後的行動。如果該企業還持續有投資(不論是投資新創或發展新事業),通常都是想好了,甚至是找到關鍵的執行角色。

其次,情感連結(人脈)在早期投資中往往扮演至關重要的因素。像劉偉這種「師生投資」的案例不僅在中國不少,在美國也不少見,甚至會發展成越洋案件。

最後,早期投資失敗是常態、絕非例外,但真正成功過的人通常更有堅持下去的信念,因為就像劉偉說的:「搞不好投到下一個『米哈游』。」人是很難靠想像就維持信念的生物,如果沒有嚐過百倍、萬倍以上的回報率,很難長期面對失敗。

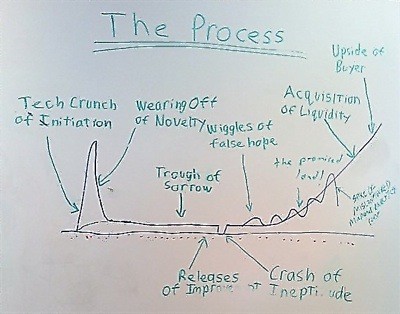

⤷ The Startup Process from the whiteboard at YC.